Creating E-Wallet Mobile App: How We Do It

08 January 2020

By limenotlemon

With a vision to make Indonesia a cashless society, one of our clients, Walepay, collaborated with us, LimeCommerce, to create a reliable, secure e-money mobile application.

We’re trying to disrupt the existing FinTech scene in Indonesia as a worthy competitor, competing with the other 53 mobile app-based FinTech businesses.

Here’s how.

Current Condition, and the Future of FinTech

Financial technology, or “FinTech,” has been developed along with the rise of the smartphone era, especially within the last 3 years.

There are tons of products that lie under the “FinTech” category.

One of them is online payment, which development has been advanced and used significantly for the last five years.

As of now, there is more than one method of online payment. One of the most popular ones (and happened to be the favorite among our employees) is the e-wallet, which growth is incrementally huge within the past few years worldwide.

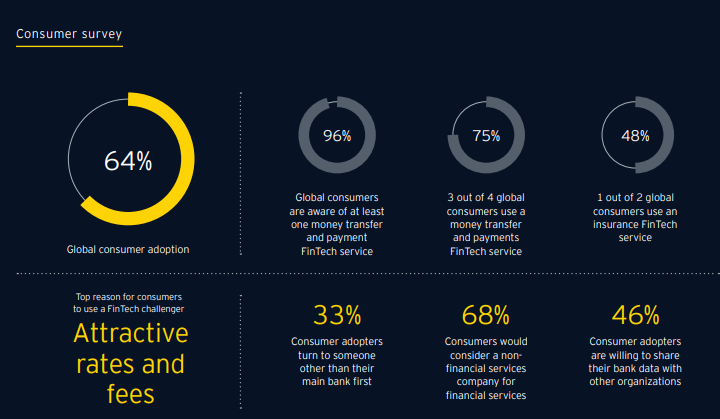

EY 2019 FinTech Consumer Survey

EY 2019 FinTech Consumer Survey

According to EY’s 2019 Global FinTech Adoption Index, almost every respondent they interviewed has already aware of the existence of FinTech, and 64% of them have used at least one FinTech product in their lives. That’s almost 100% compared to 2017’s FinTech adoption rate, which was only 33%!

They’re interested in trying new FinTech products because of the attractive rates and fees.

We also conduct a simple observation by ourselves in Indonesia (and it might apply to other countries). Small business owners started to use the existing e-wallet on their e-commerce websites to increase their revenue.

Aside from the conventional payment method such as bank transfers and credit cards, Indonesians will use a popular e-wallet like Go-Pay, OVO, and Dana.

The tally, by far, has reached 54 e-wallets in Indonesia.

And we’re sure there will be more e-wallet to join the competition in the future. The mobile app-based payment method is growing even larger, and we don’t think it’s not going to stop anytime soon.

In the future, we’ll have even more payment options. Right now, Bank Indonesia has issued the standardization of QR code-based payment.

The adoption of QR code-based payment has entered its early stage in the market.

Some eCommerce already have this payment option enabled, even for non-online-based transactions like using the KRL Commuter Line, Greater Jakarta citizens’ favorite public transportation.

With such support from the government, we could expect big adoption for QR code-based payment by Indonesian business owners shortly.

Disrupting the FinTech Industry

To stay competitive, business owners need to understand what has changed in the industry quickly:

analyze the situation, plan how to react to it, adapt accordingly.

The existence of the FinTech industry has changed the digital landscape a lot; almost every giant e-commerce in Indonesia supports payment using multiple FinTech options, whether it’s P2P lending, e-money/e-wallet, or other FinTech products.

Walepay is one of the recently joined FinTech players in the FinTech industry.

Along with the other 53 e-wallets granted by OJK (Indonesia’s Financial Services Authority), their vision is to make Indonesia a cashless society.

This vision is based on what Walepay has built two apps with us. The first one, “Walepay,” is built for the customer who wants to pay bills, mobile top-up, buy tickets, and receive payment from other users.

After generating their goals and a comprehensive mindmap of their how-to, they are ready to build the database and system that will be the spine of their business.

As the website and mobile developer for Walepay Inc., we use the integration of Magento and Ionic. Magento acted as the back-end system administrator, and Ionic backed up the system to build the user interface and user experience.

Walepay is one of the disruptors we are talking about. We helped them develop their apps and fixing bugs and errors, security threats, or new features to be built.

Essential Features of E-Wallet

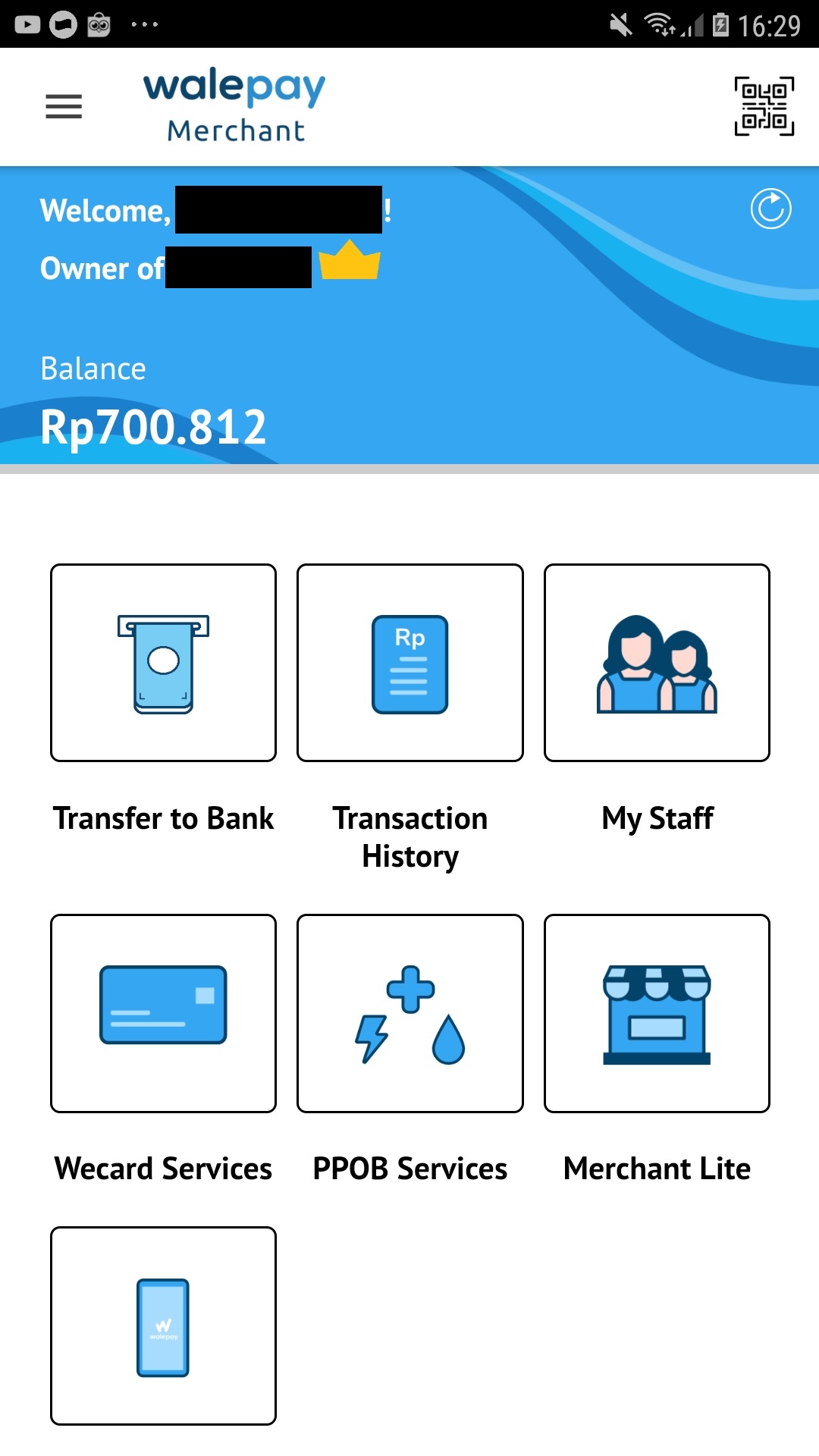

Features are built not only for the consumers but also for the administrator of the app. Walepay created 2 mobile apps for them; Walepay for the paying consumers and Walepay Merchant for the seller/shop owners. We built the features on both apps by using Magento.

Walepay’s Home Menu

Walepay’s Home Menu

Both Walepay and Walepay Merchant apps have different sets of features since the end-users are different.

But we’ll be using the Walepay Merchant app as the study case since the app is more complex than the other one. Here are some of the features we put on Walepay Merchant:

Administrator End:

- Managing Account

The first account registered on your backend system will be the first step of your new business. Yet, one is not enough. New customers and vendors will be welcomed into your system, and the administrator will need a well-developed program to manage the accounts. We developed a menu that shows the user’s ID, selfies, phone number, and authorization program. Authorization is important to keep your app safe. - Managing Price and Promotion

Let’s put our discussion for a while and see how big companies manage their e-wallet. Huge e-wallets like Gopay, OVO, and Dana have big investors behind them. That’s why they always have daily promotions to keep users stay with them. Even a growing business like Walepay also needs a system to manage prices and promotions on the backend. We built a wide range yet detailed table to put things correctly. - Money Database

We’re doing business that involves money. The money database should be the highest priority of your development. Top-up and withdrawal programs are also part of our development. Now Walepay can freely adjust the account balance of its users. - Security

Along with the money database, we also developed a security system to detect fraud, bot attacks, and other future threats. For example, a referral code could help you increase your total users, but it’s also a risky hole that a hacker could use to make bot accounts and get the money from the referral code. As the cure, we made a system to detect suspicious behavior in the system, and the admin could quickly disable the bot accounts from the backend.

User End:

- Account Registration

Following the regulation of creating a new account in an e-wallet, our developed mobile app has a feature to take your ID picture and your selfie, send it to the database, and the account will be authorized in no time. The only thing you need is your phone number. - Top up and Payment

We could develop all kinds of top-up methods for your e-wallet. Virtual account, internet banking, SMS banking, you name it. Also, you need to scan the QR code or find your friend’s number to make a payment. Super easy. - Security and Regulation

Regulation is one of the top priorities before creating your app. We always check the company background before signing our agreement. And if you already got accepted by the government, your users don’t have to worry about legality and security. The app will be shown on the Play Store and App Store. Everything is settled. - Tracking Transaction History

More accounts, more payments, more top-ups, more withdrawals. Any transactions could be traced in the transaction history. All menus are only one tap away.

Are You Planning to Join the FinTech World?

If let’s say you’re about to join the FinTech industry, which product are you going to build? Is it e-wallet/e-money like Walepay? P2P lending? Crowdfunding? Insurance? Online payment? Investment management?

Whatever the plan you have for your product, make sure to consult with the experts first before proceeding with it.